Umbrella Policy

An umbrella policy provides an extra layer of liability protection above your home and auto insurance coverage. Umbrellas kick in after the liability insurance in your homeowner and auto policy is exhausted.

You Need Umbrella Coverage

Liability insurance pays for legal fees, medical expenses, and lost wages due to negligence. Typically, a personal liability umbrella policy is inexpensive compared to the amount of protection it provides. For as little as $150 per year, you can get $1 million in additional coverage under an umbrella policy.

Be aware there are some restrictions on what an umbrella policy may cover, such as claims related to a business and intentional acts. Minimum coverage amounts should be met on home and auto policies before an umbrella policy is issued. Still, the extra coverage is vital if you have assets you need to protect.

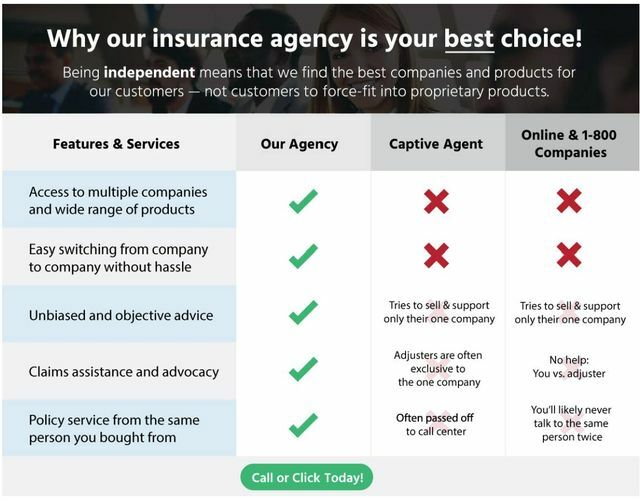

Find the Right Umbrella Policy

Example of How Extra Coverage Can Protect Your Assets

Let's say your neighbor falls and injures himself at your home or in your yard. You're liable simply because the accident occurred on your property. Suppose your neighbor requires surgery and misses months of work. In that case, the liability coverage under your homeowner policy could be inadequate (most homeowner policies typically provide a liability coverage limit of anywhere from $100,000 to $500,000).

If you must respond to a lawsuit, and the liability coverage under your homeowner's policy isn't adequate, your assets could be at risk.